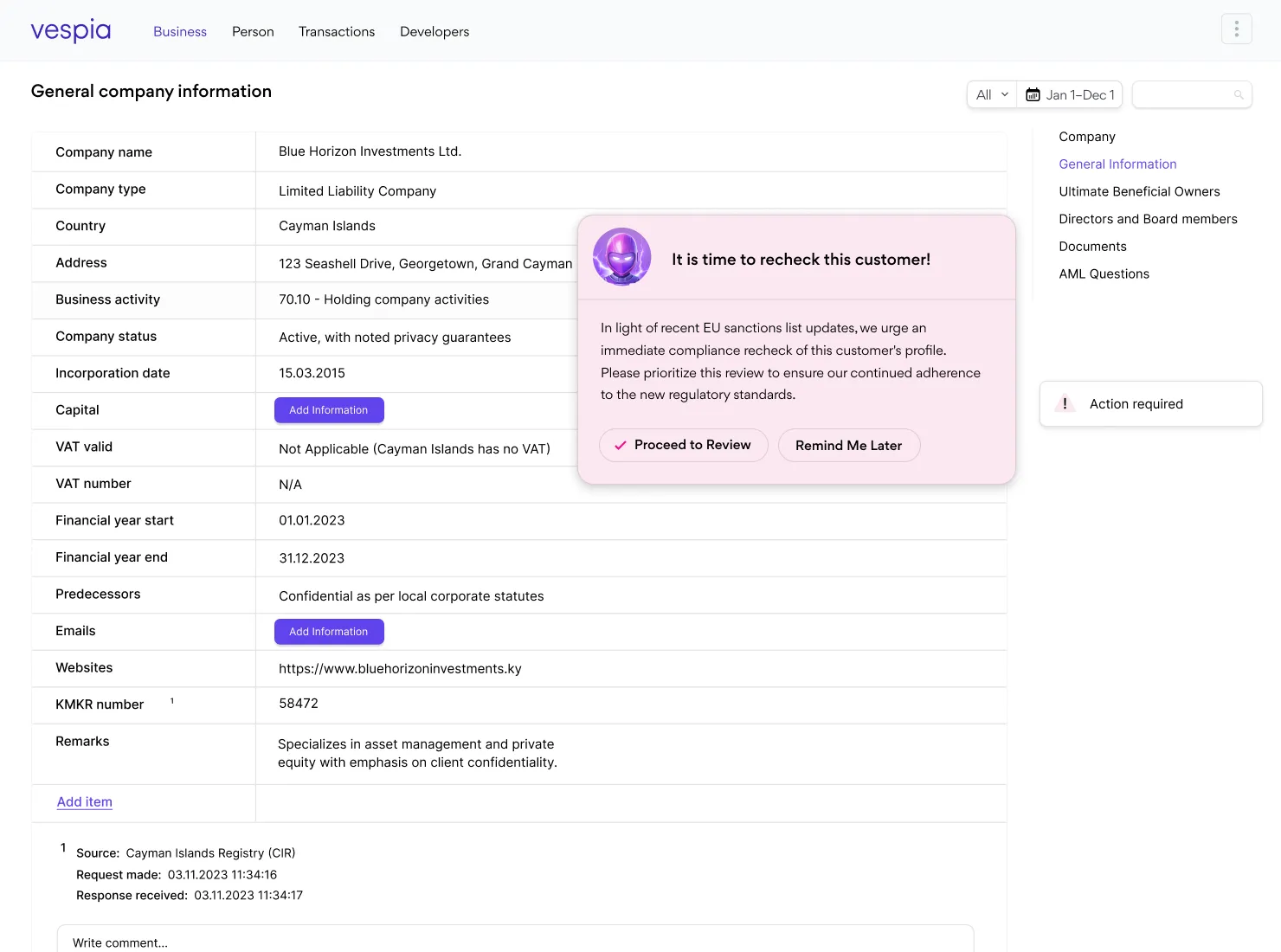

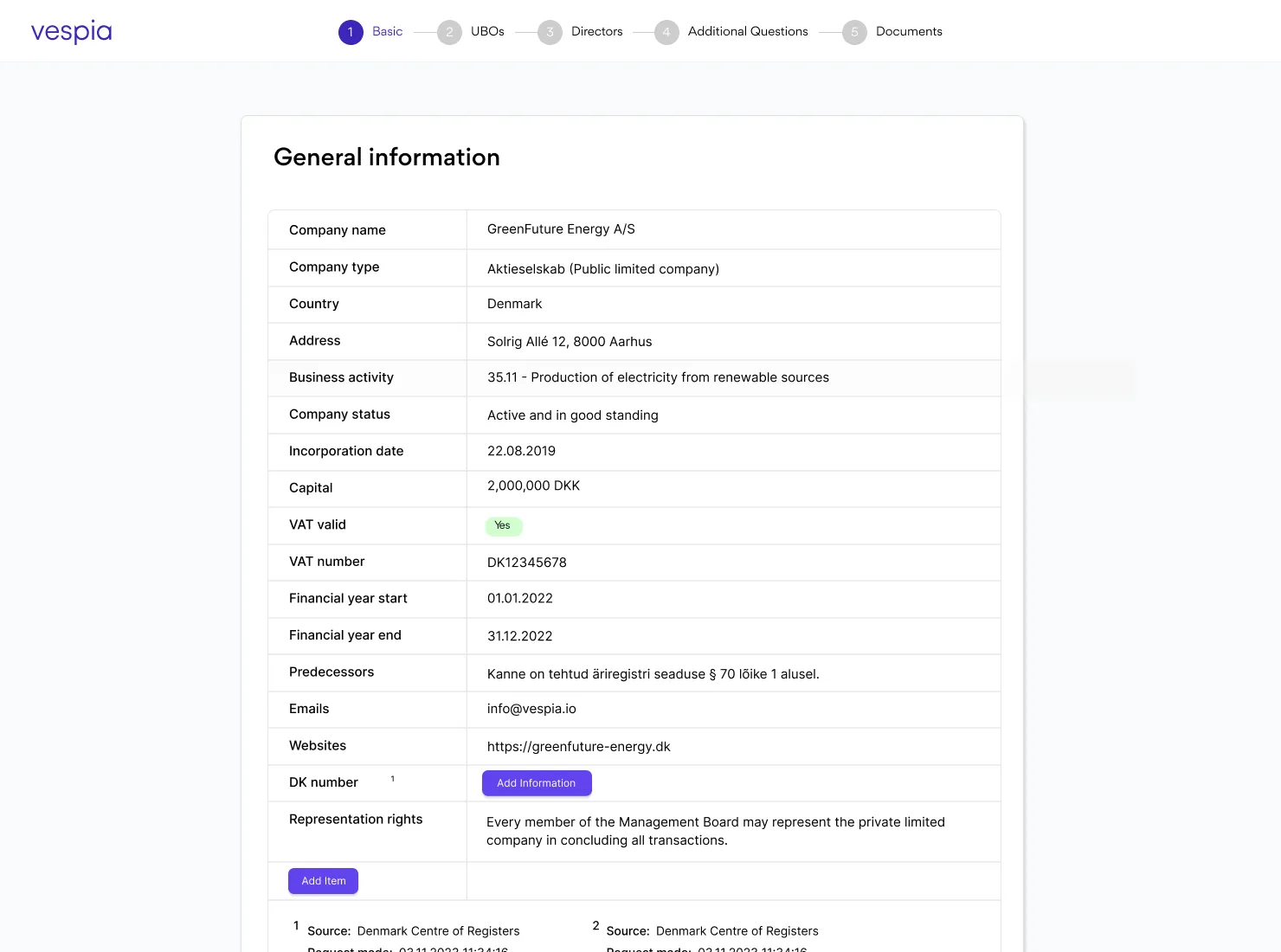

Vespia has made it easy to find out who you’re dealing with, no matter where they are established in the world. All the information you need to know is just a few clicks away.

1// RequestKybVerificationInput mutation

2

3mutation Mutation($input: RequestKybVerificationInput!) {

4 requestKybVerification(input: $input) {

5 id

6 }

7}

8

9{

10 "input": {

11 "name": "company_name",

12 "registrationCode": "registration_code",

13 "countryCode": "country_code"

14 }

151Authorization: Bearer $token

Vespia has made it easy to find out who you’re dealing with, no matter where they are established in the world. All the information you need to know is just a few clicks away.

Vespia is bringing KYB and KYC into the modern world. With their help, we make sure that our compliance team fills in the data gap in a user-friendly way to simplify the process of staying AML compliant and please the regulators.

Our experience with Vespia has been extraordinarily positive. Apart from their technological excellence and commitment to compliance, what truly sets them apart is the unparalleled support from their technical team